THE LOCK-IN EFFECT

Whether you call it the locked-in effect, golden handcuffs, the mortgage rate lockdown, kicking back, or anything else, we come to the same conclusion: high rates have kept families and potential homeowners muted and stuck in place.

It all started with COVID-19. The pandemic caused a global quarantine and less economic activity. In response to the lockdown, the Federal Reserve dropped the Federal Funds Rate to near zero to stir economic participation. In response to this movement, along with a muted economy, mortgage rates fell to a record low of 2.65% in January 2021. The low borrowing cost created an extreme seller’s market where we saw unhealthy bidding wars and most homes selling above their listing price.

The low-rate environment was too attractive for buyers to pass up, causing a surge in demand, beginning in mid-2020 and lasting until the start of 2022.

At the beginning of 2021, both inflation and job openings were increasing at a fast pace. To keep their dual mandate, inflation, and unemployment in check, the Federal Reserve began hiking the Federal Funds Rate at an unprecedented rate. From March 2022 to July 2023, the Fed hiked the Federal Funds Rate 11 times, taking rates from nearly zero to 5.5%. To put it into perspective, rates were hiked 17 times leading up to the ‘08 recession, from June 2004 to June 2006, increasing rates from 1% to 5.25%. The second fast pace the Fed took over the past couple of years to slow the economy was bound to have repercussions.

In response to increasing interest rates, borrowing costs grew, causing mortgage rates to rise from 4.09% in March 2022 to 7.22% in July 2023. With record home values and much higher rates, mortgage payments for new prospective buyers became a lot more expensive. Home affordability deteriorated dramatically. For the following months, rates rose, eclipsing 8% in October, its highest level since 2000. As a result, housing continued to slow.

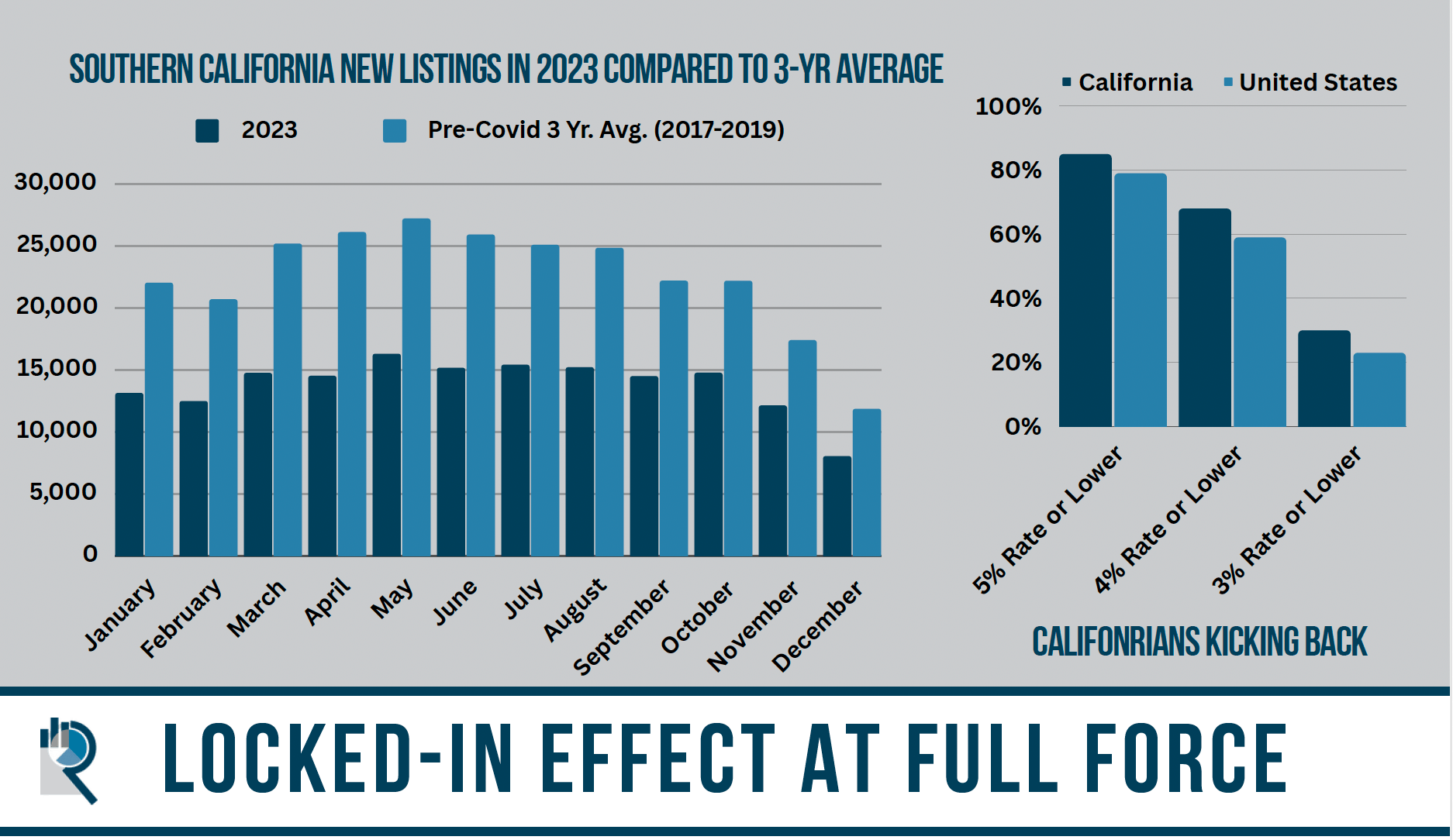

Whether you work in the real estate industry or just someone driving around their hometown, it is easy to notice the lack of FOR-SALE signs and far fewer open houses. In 2023, there were 38% fewer sellers compared to the pre-COVID 3-year average (2017-2019) in Southern California, with 105,000 missing signs. These statistics only display one part of the story.

A leading cause as to why we have not seen many homeowners willing to sell, and much fewer sales, is that homeowners are content with their low-fixed, locked-in mortgage rate. An eye-opening 85% of Californians enjoy a fixed rate of 5% or lower. As rates had recently eclipsed 8%, these homeowners were winning the battle against affordability, illustrating the true lockdown nature of rates and its impact on consume demand.

For November and December, there were 30% and 29% fewer, respectively. It will take more than rates intermittently falling to diminish the gap closer to pre-COVID levels.

Higher rates considerably constrain home affordability. The monthly payment is a deciding factor that every person strongly considers when purchasing a home. As rates rose, like they did throughout 2023, and remained at much higher levels with duration, fewer homeowners opted to sell their homes. Most owners have plenty of equity and would obtain a sizable net proceeds check if they decided to sell. However, when transitioning from a seller to a buyer, one quickly notices the true impact of rates. If a buyer looked at a home when rates were 7%, and then just a few weeks later, as rates eclipsed 8%, the mortgage payment jumps by hundreds of dollars per month and by thousands a year. As mortgage rates eased in the last couple of months of 2023, more sellers opted to purchase, and demand increased.

2023 can easily be recognized as a year when housing took a turn for the worse. Buyers faced an anemic housing supply, increasing rates, rising home values, and fewer available homes for sale. For now, as we turn to 2024, we can brush off the frustrations of the past year and look forward to a year with far more potential.

Categories

- All Blogs (21)

- *Buyers (16)

- *Commercial Real Estate (8)

- *Community Event (7)

- *Industry News (16)

- *Luxury Real Estate (12)

- *Market Updates (13)

- *Mortgage News (12)

- *Probate Sales (11)

- *Renters (12)

- *Sellers (15)

- *Short Sales (14)

- Anaheim Hills (16)

- Brea (16)

- Community News (14)

- Corona del Mar (16)

- Costa Mesa (16)

- Dana Point (16)

- Divorce Real Estate (15)

- Fullerton (17)

- Huntington Beach (16)

- Irvine (16)

- Ladera Ranch (16)

- Laguna Beach (16)

- Newport Beach (16)

- Newport Coast (16)

- North Tustin (16)

- Open House (11)

- Orange Park Acres (16)

- Yorba Linda (16)

Recent Posts

“My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! ”