Understanding Orange County's Latest Real Estate Market Trends.

The Southern California real estate market has always been a subject of interest for both buyers and sellers. With the dynamic shifts in the market, especially in the Orange County area, it's crucial to stay informed about the latest trends. This article delves into the recent changes in the market, offering insights that are vital for making informed decisions.

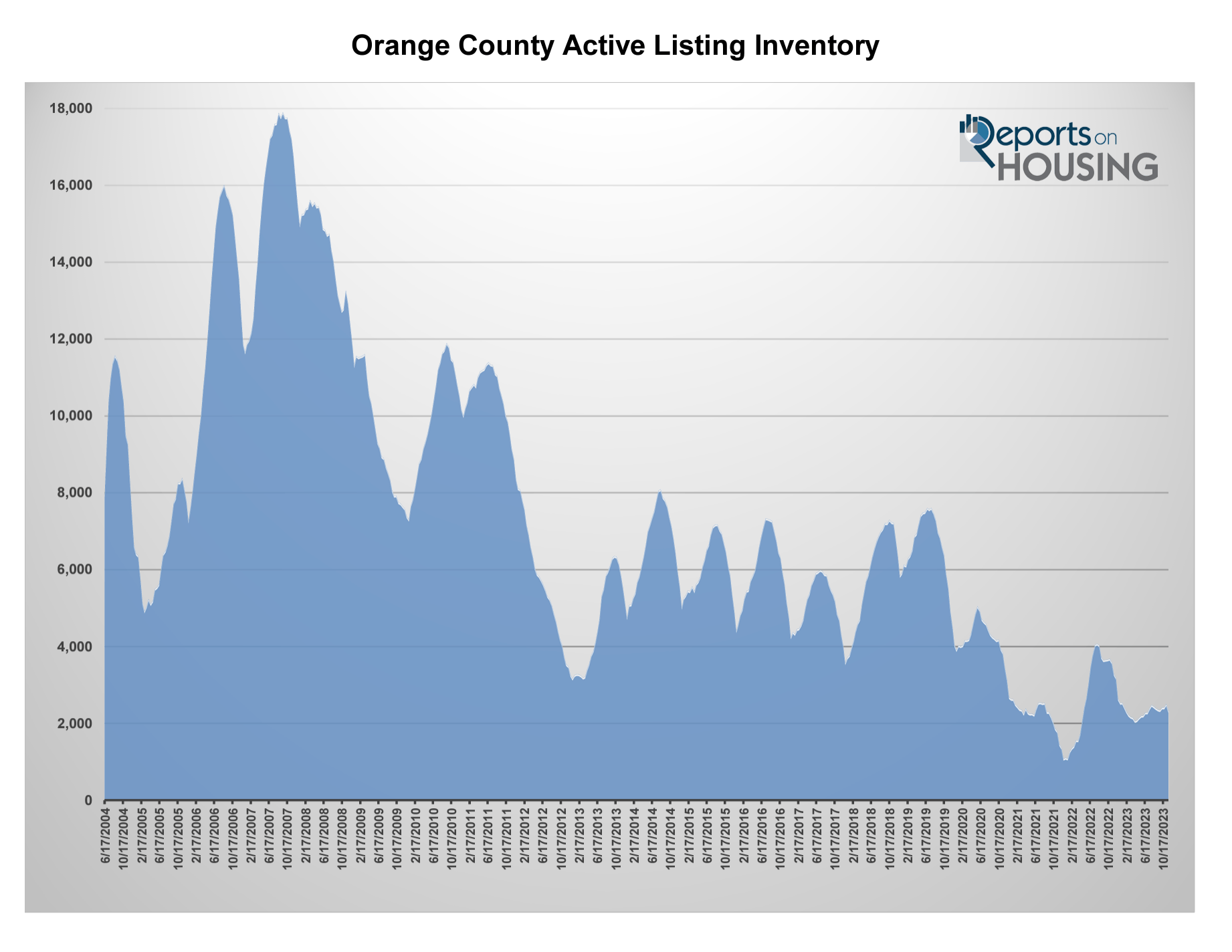

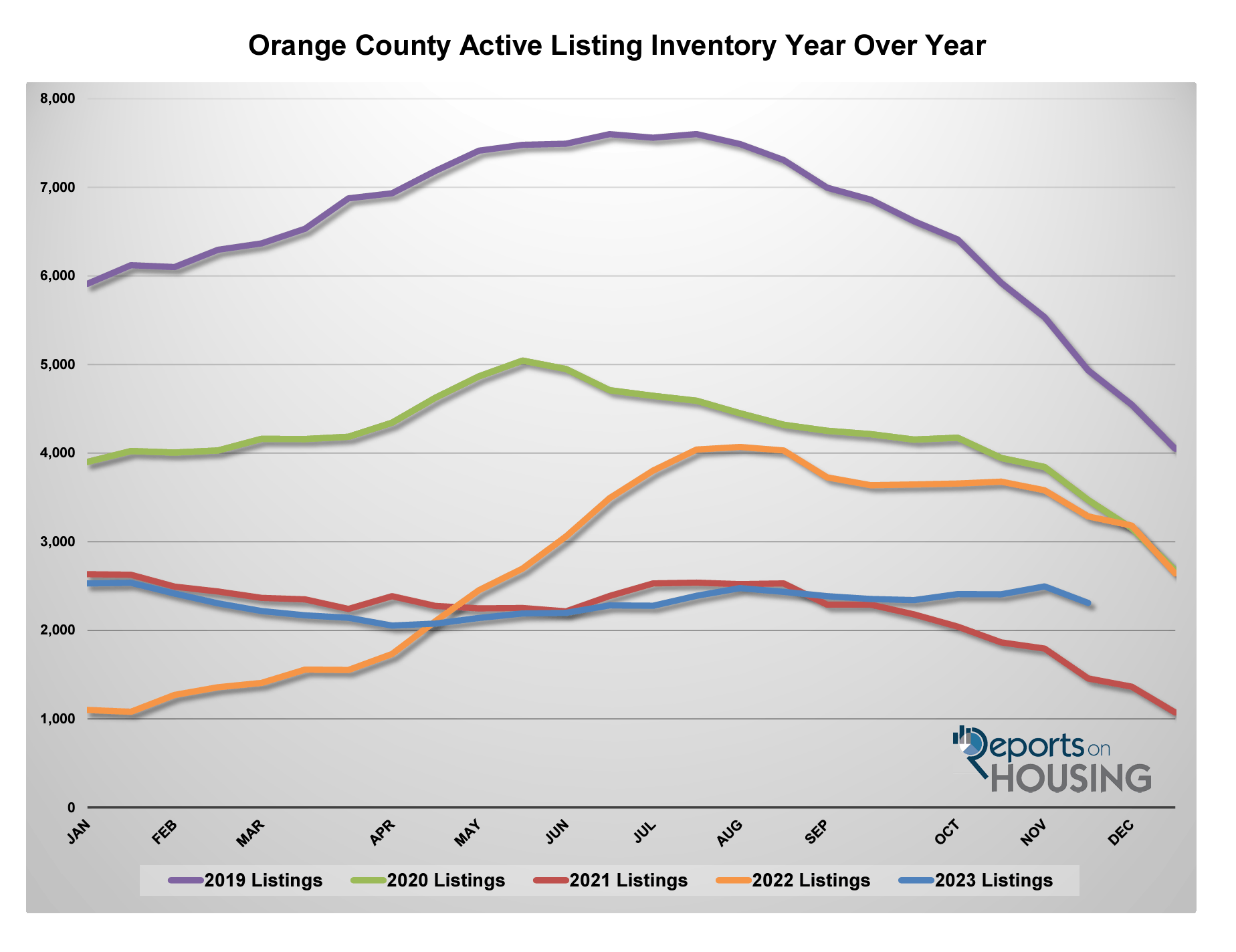

Significant Drop in Active Listings

In the past few weeks, we've observed a substantial decrease in the active listing inventory. There has been a plunge of 187 homes, down 7%, leaving the inventory at 2,309 - the lowest since early July. This drop is also the most significant we've seen this year. Compared to the 3-year average before COVID (2017-2019), there are 1,093 fewer homes on the market, a 36% decrease.

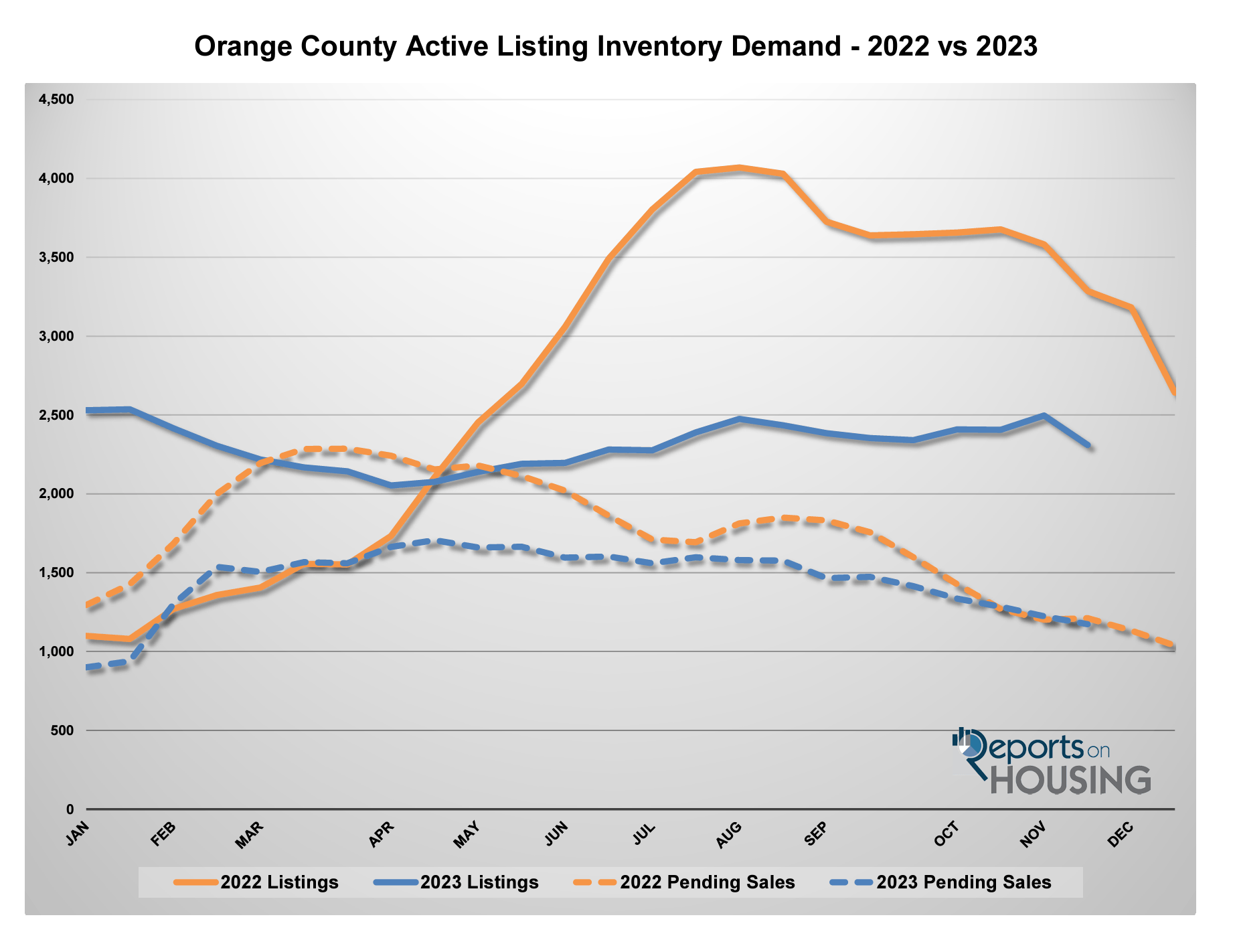

Changes in Demand

Demand, as measured by the number of pending sales over the past month, also saw a decrease. It dropped by 50 pending sales, down 4%, totaling 1,173 - the lowest since records began in 2004. Compared to the same period last year, the demand is 3% lower. The 3-year average before COVID was 1,969 pending sales, 68% higher than today's numbers.

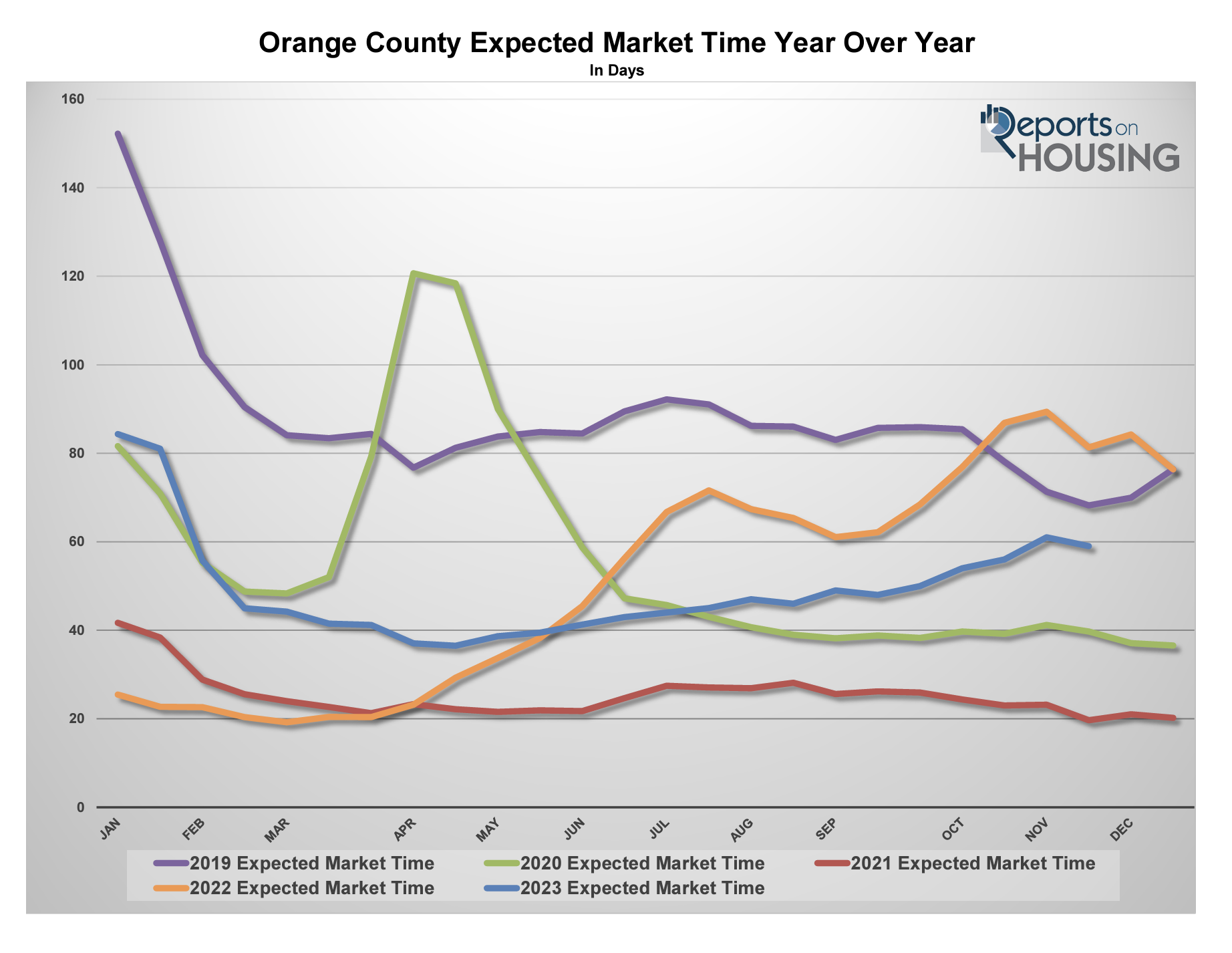

Expected Market Time

The Expected Market Time, which is the number of days to sell all Orange County listings at the current buying pace, saw a decrease from 61 to 59 days. This change indicates a faster-moving market compared to last year's 81 days and the 85-day average before COVID.

Breakdown by Price Range:

Below $750,000: Expected Market Time decreased from 45 to 41 days. This range represents 19% of the active inventory and 27% of demand.

$750,000 to $1 Million: Expected Market Time decreased from 41 to 38 days. This range accounts for 16% of inventory and 24% of demand.

$1 Million to $1.25 Million: Expected Market Time decreased from 46 to 44 days. This segment comprises 10% of inventory and 14% of demand.

$1.25 Million to $1.5 Million: Expected Market Time decreased from 46 to 44 days, representing 9% of inventory and 12% of demand.

$1.5 Million to $2 Million: Expected Market Time decreased from 70 to 68 days, with 13% of inventory and 11% of demand.

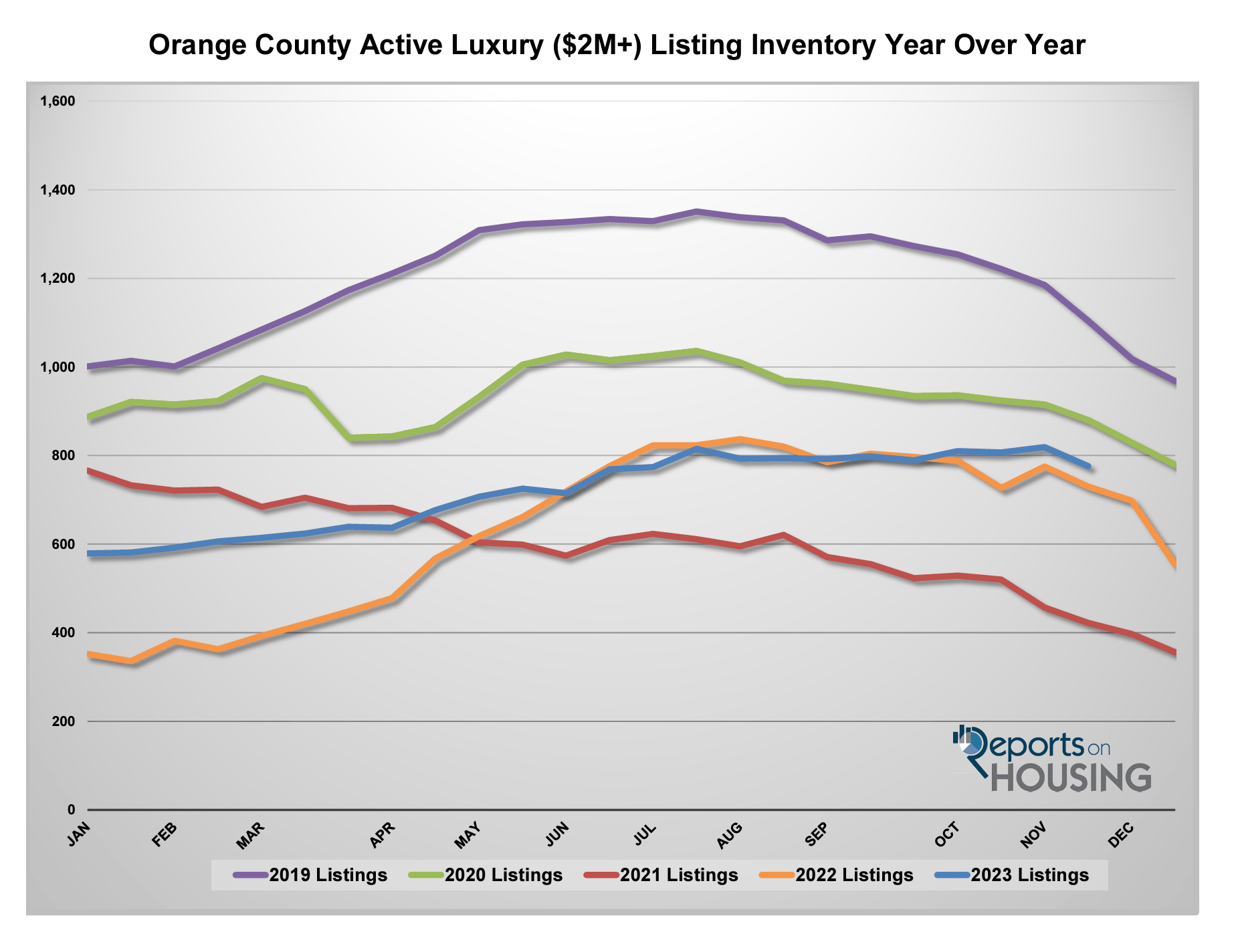

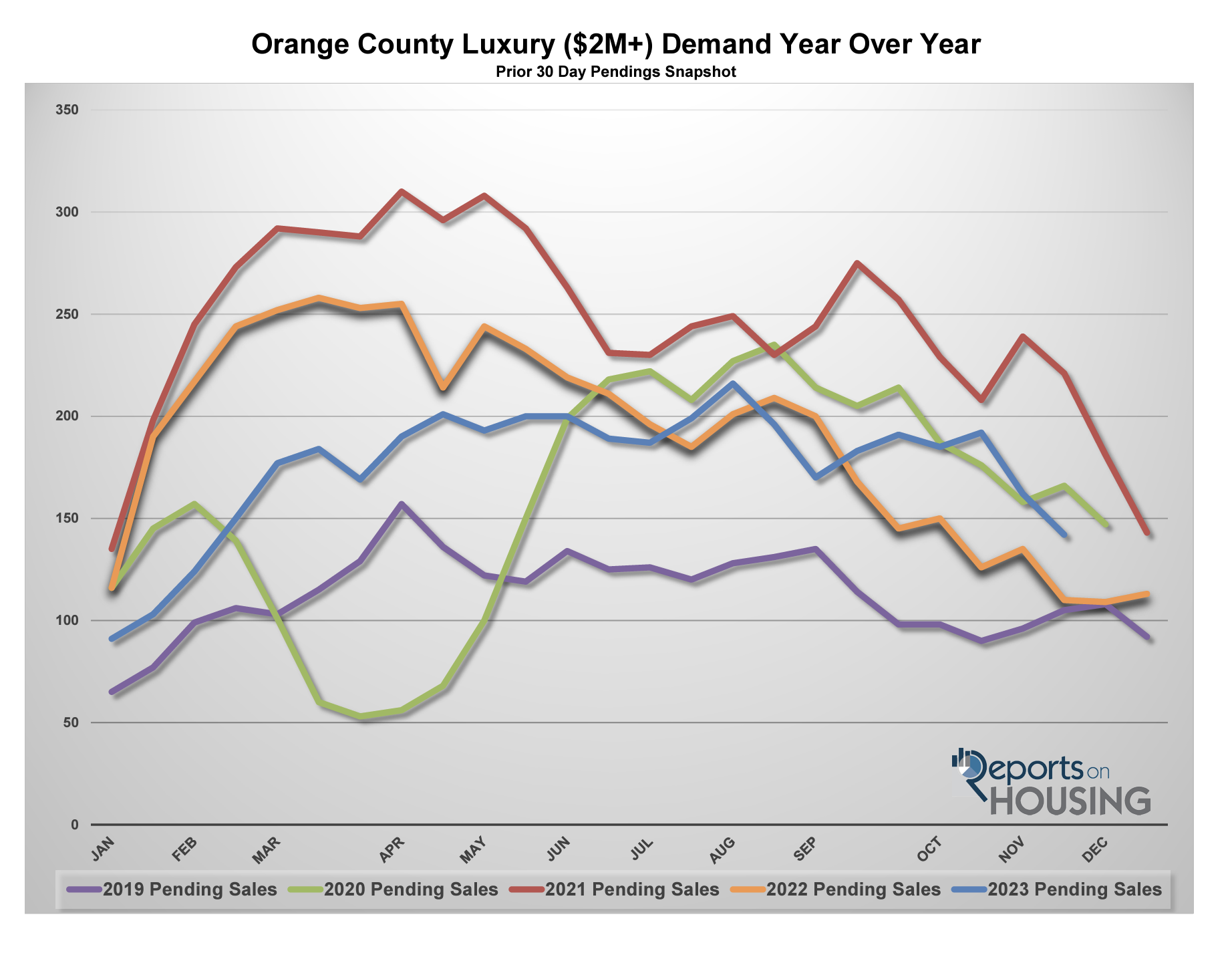

Above $2 Million: Expected Market Time showed varied trends based on price brackets. [Explore luxury market trends](#).

Luxury Market and Distressed Homes

The luxury end (homes above $2 million) accounts for 33% of the inventory and 12% of demand. Distressed homes, including short sales and foreclosures, make up a small fraction of the listings (0.3%) and demand (0.1%).

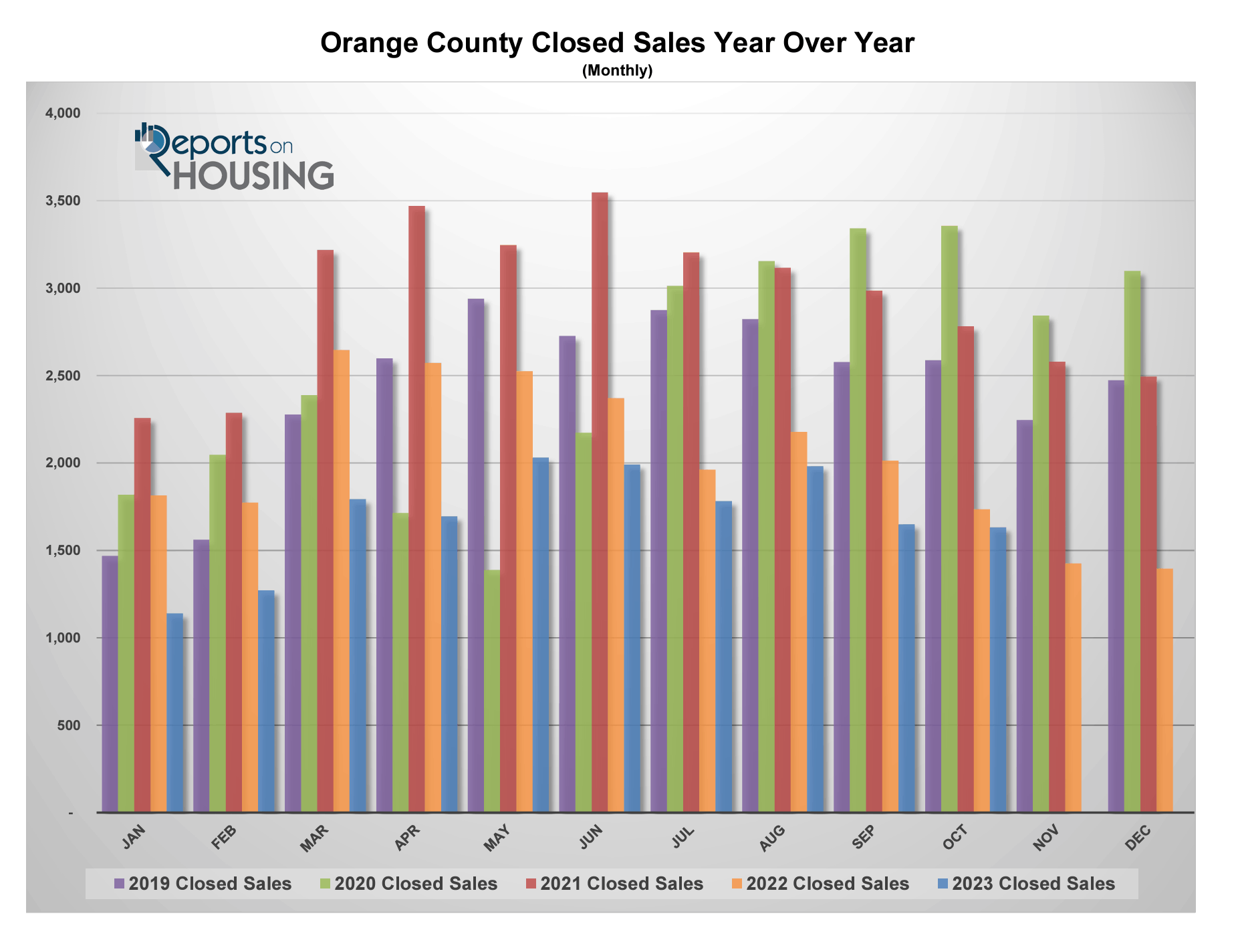

Closing Sales in October

October saw 1,632 closed residential resales, a 5% decrease from October 2022. The sales-to-list price ratio stood at 98.9% for all of Orange County. Distressed properties accounted for a minimal portion of these sales.

The Southern California real estate market, particularly in Orange County, is experiencing significant shifts. These changes have profound implications for buyers and sellers alike. Staying updated with these trends is key to navigating the market successfully. For more insights and detailed analyses, visit [The Cole Group's Real Estate Blog] http://thecolegroup.co

Graphs Provided by: Reports on Housing

Categories

- All Blogs (21)

- *Buyers (16)

- *Commercial Real Estate (8)

- *Community Event (7)

- *Industry News (16)

- *Luxury Real Estate (12)

- *Market Updates (13)

- *Mortgage News (12)

- *Probate Sales (11)

- *Renters (12)

- *Sellers (15)

- *Short Sales (14)

- Anaheim Hills (16)

- Brea (16)

- Community News (14)

- Corona del Mar (16)

- Costa Mesa (16)

- Dana Point (16)

- Divorce Real Estate (15)

- Fullerton (17)

- Huntington Beach (16)

- Irvine (16)

- Ladera Ranch (16)

- Laguna Beach (16)

- Newport Beach (16)

- Newport Coast (16)

- North Tustin (16)

- Open House (11)

- Orange Park Acres (16)

- Yorba Linda (16)

Recent Posts

“My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! ”